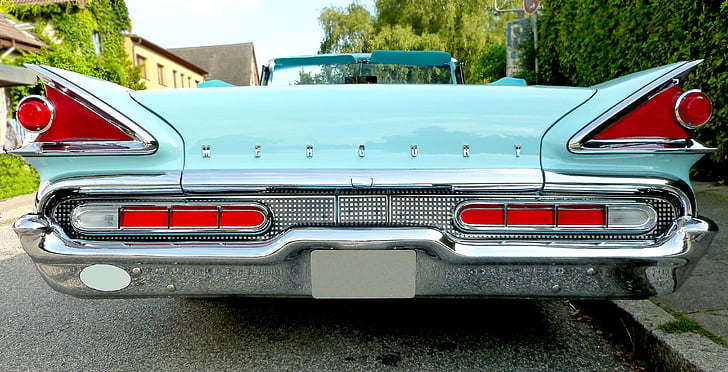

Many car lovers seek classic car ownership as a way to preserve history and to signify a commitment to vehicle ownership. Even though these special advantages make classic cars unique, their owners still need to have insurance to protect their investment. But how does usage affect the insurance rates for classic cars?

Understanding Classic Car Insurance Rates

Classic cars are traditionally valued differently than newer vehicles. They are used to either show off, enter competitions or to keep them in pristine condition. Because of their age and value, providers use different methods when calculating rates. Factors such as modification, condition and age can all contribute to how much you’ll pay for insurance.

Premiums for collectors tend to be higher than for a standard car. Since classic cars are typically driven less, it’s important to take into consideration the amount of mileage before getting coverage. Drivers need to accurately assess their cars for an insurance plan that’s best suited to them.

Why Mileage Matters for Classic Car Insurance Rates

The amount of coverage you choose for your classic car will affect your rates. The more coverage you buy, the higher your rates. While you can purchase extra coverage as needed, your premiums will go up if you don’t limit your driving. The amount of driving you do can affect your rates, the higher your mileage the higher your rates.

Lower mileage can give you discounts on your classic car. Low mileage is seen as beneficial because it means that classic cars can often be in better condition, or have had less wear and tear than higher mileage cars. Lower mileage also indicates that you’re likely taking better care of your car, and it’s less likely to be involved in an accident.

As a result, you’ll likely get favorable rates if you “remain” with the same provider and keep your mileage low. Before selecting a plan, it’s important to get an accurate estimate of your mileage so you can better calculate your premiums.

Tips for Saving Money on Classic Car Insurance

-

- Shop around for the best rates

-

- Get discounts for safety features (anti-theft systems, alarms, etc.)

-

- Choose the right coverage

-

- Maintain a good driving record

-

- Keep your mileage low

When it comes to classic car insurance, mileage matters! Keeping your mileage as low as possible can help you save money on your premiums. It’s important to accurately assess your driving habits so you can get the best possible rates.